The Audit Committee has prepared the following report on its activities with respect to our audited consolidated financial statements for the fiscal year ended December 31, 2012.2019.

Our management is responsible for the preparation, presentation and integrity of our consolidated financial statements. Management is also responsible for maintaining appropriate accounting and financial reporting practices and policies as well as internal controls and procedures designed to provide reasonable assurance that the Company is in compliance with accounting standards and applicable laws and regulations.

The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1, AU Section 380), as adopted by the Public Company Accounting Oversight Board (PCAOB) in Rule 3200T. Ernst & YoungPricewaterhouseCoopers LLP has provided the Audit Committee with the written disclosures and letter required by PCAOB Ethics and Independence Rule 3526, Communication with Audit Committees concerning Independence, and the Audit Committee discussed with the independent registered public accounting firm that firm’s independence.

The independent registered public accounting firm is responsible for planning and performing an independent audit of our consolidated financial statements in accordance with auditing standards of the Public Company Accounting Oversight Board (United States) and for auditing the effectiveness of our internal control over financial reporting. The independent registered public accounting firm is responsible for expressing an opinion on the conformity of those audited consolidated financial statements with accounting principles generally accepted in the United States. In this context, the Audit Committee has reviewed and discussed the audited consolidated financial statements for the year ended December 31, 2012,2019, with management and the independent registered public accounting firm, Ernst & YoungPricewaterhouseCoopers LLP.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board that the audited consolidated financial statements referred to above be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2012.Report.

Paul W. Sandman

The Litigation Committee has adopted a written charter that is available on the Company’s website at www.pdl.com.

providing oversight in the evaluation of ourthe Board and each committee of ourthe Board.

OurThe Nominating and Governance Committee has adopted a written charter that is available on the Company’s website at www.pdl.com.

Evaluation of Director Nominations

In fulfilling its responsibilities to select and recommend to ourthe Board director nominees for each election of directors, ourthe Nominating and Governance Committee considers the following factors:

the appropriate size of ourthe Board and its committees;

the perceived needs of ourthe Board for particular skills, diversity, background and business experience;

the skills, background, reputation and business experience of nominees compared to the skills, background, reputation and business experience already possessed by other Board members;

the nominees’ independence from management;

the applicable regulatory and listing requirements, including independence requirements and legal considerations, such as antitrust compliance;

the benefits of a constructive working relationship among directors; and

the desire to balance the considerable benefit of continuity with the periodic injection of thea fresh perspective provided by new members.

OurThe Nominating and Governance Committee’s goal is to assemble a board of directors that brings to the Company a variety of perspectives and skills derived from high quality business and professional experience. Directors should possess the highest personal and professional ethics, integrity and values, and be committed to representing the best interests of our stockholders. They must also have an inquisitive and objective perspective and mature judgment. Director candidates, in the judgment of ourthe Nominating and Governance Committee, must also have sufficient time available to perform all Board and committee responsibilities. Board members are expected to prepare for, attend and participate in all Board and applicable committee meetings.

The Nominating and Governance Committee has defined “diversity” for purposes of evaluating director candidates. Under the Nominating and Governance Committee’s selection criteria, diversity means experience, professional skill, geographic representation and educational and professional background necessary to assist the Board in the discharge of its responsibilities. The Nominating and Governance Committee looks at the composition of the Board as a whole Board when considering diversity and seeks nominees whose experience, professions, skills, geographic representation and backgrounds complement and create diversity among the directors. The Nominating and Governance Committee does not assign specific weights to any criteria and no particular criterion is necessarily applicable to all prospective nominees.

The same standards apply to any nominee, regardless of whether recommended internally or by stockholders.

Other than the foregoing, there are no stated minimum criteria for director nominees, although ourthe Nominating and Governance Committee may also consider such other factors as it may deem to be in the best interests of the Company and our stockholders. OurThe Nominating and Governance Committee annually evaluates all Board members and the Board as a whole. It also evaluates those directors whose terms expire that year and who are willing to continue in service against the criteria set forth above in determining whether to recommend those directors for reelection. The Nominating and Governance Committee has determined that the Board and its members meet such criteria in 2013.criteria.

Candidates for Nomination

Candidates for nomination as director come to the attention of ourthe Nominating and Governance Committee from time to time through incumbent directors, management, stockholders or third parties. These candidates may be considered at meetings of ourthe Nominating and Governance Committee at any point during the year. Such candidates are evaluated against the criteria set forth above. If ourthe Nominating and Governance Committee determines at any time that it is desirable that ourfor the Board to consider additional candidates for nomination, the Nominating and Governance Committee may poll directors and management for suggestions or conduct research to identify possible candidates and may, if ourthe Nominating and Governance Committee thinksdeems it is appropriate, engage a third-party search firm to assist in identifying qualified candidates.

OurThe Nominating and Governance Committee has adopted a policy to evaluate any recommendation for director nominee proposed by a stockholder, and our Bylaws also permit stockholders to nominate directors for consideration at an annual meeting, subject to certain conditions. Any recommendation for a director nomination must be submitted in writing to:

PDL BioPharma, Inc.

Attention: Corporate Secretary

932 Southwood Boulevard

Incline Village, Nevada 89451

Our Bylaws require that any director nomination made by a stockholder for consideration at an Annual Meetingannual meeting must meet the requirements set forth in the Bylaws and be received in writing not less than ninety (90)90 calendar days nor more than one hundred twenty (120)120 calendar days in advance of the date of the one-year anniversary of the Company’s (or the Company’s predecessor’s) previous year’s annual meeting of stockholders. However, if no annual meeting was held in the previous year or the date of the annual meeting is more than 30 calendar days before or more than 60 calendar days after such anniversary date, such notice by the stockholder to be timely must be received by the Secretary of the Company not later than the close of business on the 90th calendar day prior to such annual meeting or, if later, the 10th calendar day following the day on which such notice of the date of the meeting was mailed or such public disclosure was made.

Each written notice containing a stockholder nomination of a director at an annual meeting must include as to the stockholder submitting the nomination:

the name and address, as they appear on the Company’s books, of such stockholder and the name and address of the beneficial owner, if any, on whose behalf a proposal of nomination to election of directors is made;

the class, series and number of shares of capital stock of the Company whichthat are owned beneficially and of record by such stockholder and such beneficial owner;

a representation that such stockholder will notify the Company in writing of the class and number of such shares owned beneficially and of record by such stockholder and such beneficial owner as of the record date for the meeting (or action, as applicable) promptly following the later of the record date or the date notice of the record date is first publicly disclosed;

any option, warrant, convertible security, stock appreciation right, derivative, swap or similar right with an exercise or conversion privilege or a settlement payment or mechanism at a price related to any class or series of shares of the Company or with a value derived in whole or in part from the value or volatility of any class or series of shares of the Company, whether or not such instrument or right shall convey any voting rights in such shares or shall be subject to settlement in the underlying class or series of capital stock of the Company or otherwise (a Derivative Instrument), directly or indirectly owned beneficially by such stockholder or beneficial owner and any other direct or indirect opportunity of such stockholder or beneficial owner to profit or share in any profit derived from any increase or decrease in the value of shares of the Company and a representation that such stockholder will notify the Company in writing of any such Derivative Instrument or other direct or indirect opportunity to profit or share in any profit in effect as of the record date for the meeting (or action, as applicable) promptly following the later of the record date or the date notice of the record date is first publicly disclosed;

any proxy, contract, arrangement, understanding or relationship pursuant to which such stockholder or beneficial owner has a right to vote any shares of any security of the Company;

any rights to dividends on the shares of the Company owned beneficially by such stockholder or beneficial owner that are separated or separable from the underlying shares of the Company;

any proportionate interest in shares of capital stock of the Company or Derivative Instruments or other direct or indirect opportunity to profit or share in any profit held, directly or indirectly, by a general or limited partnership in which such stockholder or beneficial owner is a general partner or, directly or indirectly, beneficially owns an interest in a general partner;

any performance related fees (other than an asset based fee) that such stockholder or beneficial owner is entitled to base on any increase or decrease in the price or value of shares of any class or series of the Company, or any Derivative Instruments or other direct or indirect opportunity to profit or share in any profit, if any;

a description of any agreement, arrangement or understanding with respect to the proposal of nomination between or among such stockholder and such beneficial owner, any of their respective affiliates or associates, and any others acting in concert with any of the foregoing, and a representation that such stockholder will notify the Company in writing of any such agreements, arrangements or understandings in effect as of the record date for the meeting (or action, as applicable) promptly following the later of the record date or the date notice of the record date is first publicly disclosed;

a description of any material interest of such stockholder and such beneficial owner, if any, on whose behalf the proposal is made and of any material benefit that such stockholder and such beneficial owner, if any, on whose behalf the proposal is made expects or intends to derive from such business or action, as applicable;

a representation that such stockholder is a holder of record of stock of the Company entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to propose such nomination or a representation that such stockholder is a holder of record of stock of the Company entitled to consent to corporate action in writing without a meeting, as applicable;

a representation whether such stockholder or such beneficial owner, if any, intends or is part of a group which intends (i) to deliver a proxy statement and/or form of proxy (or consent, as applicable) to holders of at least the percentage of the Company’s outstanding capital stock required to elect the nominee and/or (ii) otherwise to solicit proxies (or consents, as applicable) from stockholders in support of such nomination; and

any other information that is required to be provided by such stockholder pursuant to Section 14 of the Securities Exchange Act, of 1934, as amended (the Exchange Act), and the rules and regulations promulgated thereunder (or any successor provision of the Exchange Act or the rules or regulations promulgated thereunder), in such stockholder’s capacity as a proponent of a stockholder nomination.

Each written notice containing a stockholder nomination of a director at an annual meeting must include for each person whom the stockholder proposes to nominate for election or reelection as a director:

the name, age, business address and residence address of the person,

person;

the principal occupation or employment of the person,person;

the class, series and number of shares of capital stock of the CorporationCompany that are owned beneficially and of record by the person,person;

a statement as to the person’s citizenship,citizenship;

the completed and signed representation and agreement described in the Bylaws,Bylaws;

a description of all direct and indirect compensation and other material monetary agreements, arrangements and understandings during the past three years, and any other material relationships, between or among such stockholder and beneficial owner, if any, and their respective affiliates and associates, or others acting in concert therewith, on the one hand, and the person, and his or her respective affiliates and associates, or others acting in concert therewith, on the other hand, including, without limitation, all information that would be required to be disclosed pursuant to Item 404 promulgated under Regulation S-K if the stockholder making the nomination and any beneficial owner on whose behalf the nomination is made, if any, or any affiliate or associate thereof or person acting in concert therewith, were the “registrant” for purposes of such rule and the person were a director or executive officer of such registrant,registrant;

any other information relating to the person that is required to be disclosed in solicitations for proxies for election of directors pursuant to Section 14 of the Exchange Act,Act; and

such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected.

All director nominees must also complete a customary form of director’s questionnaire as part of the nomination process. The evaluation process may also include interviews and additional background and reference checks for non-incumbent nominees, at the discretion of ourthe Nominating and Governance Committee.

Code of Ethics

The Company has adopted a Code of Business Conduct (the Conduct Code) that applies to all officers, directors and employees. The Conduct Code is available on our website at www.pdl.com. IfIn the event we ever were to amend any provision of the Conduct Code, we intend towill satisfy our disclosure obligations with respect to any such amendment by posting such information on our Internet website set forth above rather than by filing a Current Report on Form 8-K. Any waiver of the Conduct Code will be disclosed by filing a Current Report on Form 8-K.

Board Leadership Structure

The Board does not have a policy regarding the separation of the roles of chief executive officer and chairperson ofFrom March 2009 to April 2019, the Board as the Board has determined that it is in the best interests of the Company to make that determination based on the position and direction of the Company and the membership of the Board. Since March 2009, the Board has beenwas led by a Lead Director insteadDirector. However, in April 2019, the Board changed this role to Chairperson, while retaining the independence requirements that had previously applied to the role of a Chairperson.Lead Director. Under our corporate governance principles, the Lead DirectorChairperson of the Board is responsible for coordinating the Board’s activities, including the scheduling of meetings of the full Board, scheduling executive sessions of the non-employee directors and setting relevant items on the agenda (in consultation with the chief executive officer as necessary or appropriate). The Chairperson must be an independent member of the Board. The Board thinksbelieves that this leadership structure, consisting of an independent member of the Board as the Lead Director, has enhancedChairperson, enhances the Board’s oversight of, and independence from, Company management and our overall corporate governance. Dr. Selick,Ms. O’Farrell, an independent member of the Board, currently serves as our Lead Director.the Chairperson.

Risk Oversight by the Board

Companies face a variety of risks, including credit risk, market risk, liquidity risk and operational risk. The Board thinksbelieves that an effective risk management system will: (i) timely identify the material risks that the Company faces, (ii) communicate necessary information with respect to material risks to senior executives and, as appropriate, to the Board or relevant Board committee, (iii) implement appropriate and responsive risk management strategies consistent with the Company’s risk profile and (iv) integrate risk management into Company decision-making.

The Board has designated the Audit Committee to take the lead in overseeing risk management. The Company’s management prepares periodic reports to the Audit Committee and the Board discussing in detail the known and anticipated risks to the Company and the Company’s approach to mitigating such risks. Based on such reports, the Audit Committee makes periodic reports to the Board as well as the Audit Committee’s own analysis and conclusions regarding the adequacy of the Company’s risk management processes.

In addition to the formal compliance program, the Board encouragesand management to promote a corporate culture that incorporates risk management into the Company’s corporate strategy and day-to-day business operations.

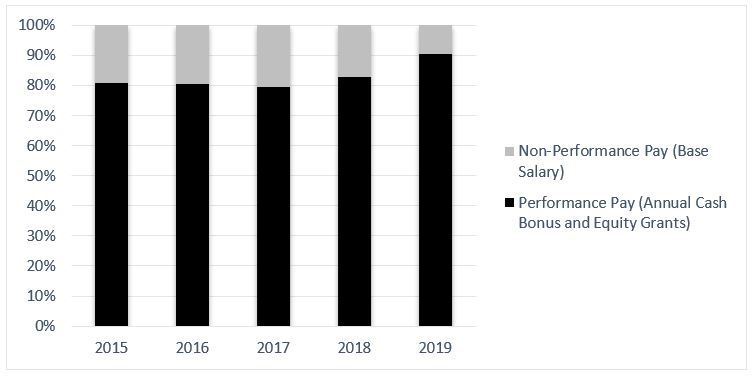

Risk Assessment of Compensation Policies

In January 2013,Most recently in April 2020, the Board, with the assistance of management,Board Advisory, conducted a risk assessment of the Company’s compensation policies and practices. The Company’s compensation policies and practices were evaluated to ensure that they do not foster risk taking above the level of risk associated with the Company’s business model. For this purpose, the Compensation Committee worked closely with Board considered the Company’s long-term strategyAdvisory to ensure that pay levels and compared it to the performance metrics were reasonable from an external competitive perspective and time horizonaffordable and reasonable within the context of the Company’s compensation policiescurrent and practicesprojected long-term financial performance. The Compensation Committee assessed the Company’s mix of pay (cash versus equity and short- versus long-term) from a competitive and strategic perspective, and found it reasonable and supportive of the business strategy.

Based on the Compensation Committee’s work and the Company’s useassessment conducted with the assistance of cash and restricted stock as the primary means of compensation. Based on this assessment,Board Advisory, the Board concluded that its pay and performancecompensation program does not promote excessive risk taking. In this regard, the Company notes that:

the Company’s annual incentive compensation is based on balanced performance metrics set by the Compensation Committee that promote disciplined progress towards Company goals;

uses third-party corporate governance reviews of the Company’s long-term incentives do not drive high-risk investments atpublic filings to assess the expensereasonableness of long-term Company value;

pay levels, CEO pay-for-performance alignment and risk profile;the Compensation Committee uses an independent compensation consultant who (i) assesses the competitiveness of each component of the Company’s compensation programspackage in relation to its peers in the healthcare industry and (ii) provides the Compensation Committee with a risk assessment report no less than annually;

the Company uses explicit and discrete goals in its design of incentive plans and such plans are weighted towards cash, and the equity component does not promote unnecessary risk taking and encourages sensible income generating asset investments; and

reasonable in relation to the Company’s compensation awards are capped at reasonable and sustainable levels, as determined by a review of the Company’s economicsize, financial position and prospects, as well as business objectives; and

the compensation offered by comparable companies.

Company uses reasonable maximum caps in its incentive plan design.

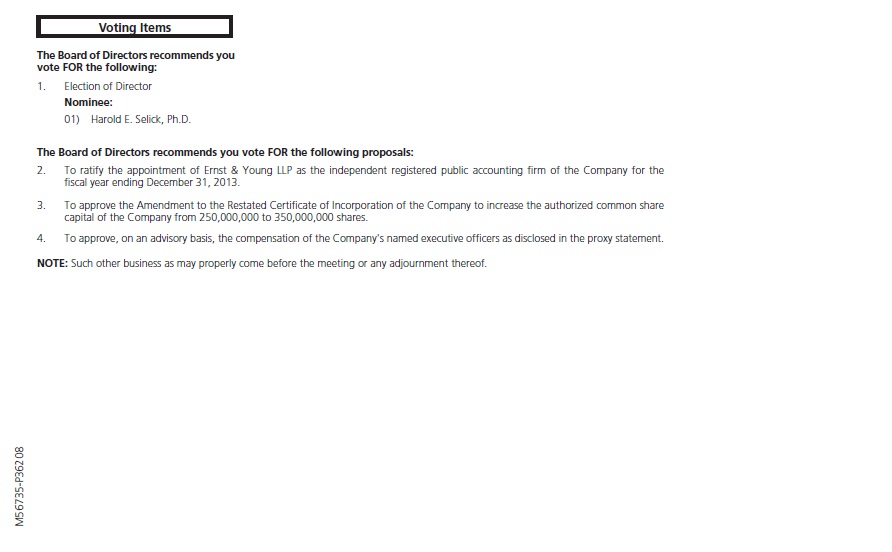

PROPOSAL NO. 2:

RATIFICATION OF SELECTION OF ERNST & YOUNGPRICEWATERHOUSE COOPERS LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee, which is comprised entirely of the Boardindependent directors, has selected Ernst & YoungPricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2013,2020, and the Board has directed that management submit the selection of its independent registered public accounting firm for ratification by the stockholders at the Annual Meeting. Ernst & YoungPricewaterhouseCoopers LLP has audited the Company’s consolidated financial statements since 1986.for the fiscal year ended December 31, 2019. Representatives of Ernst & YoungPricewaterhouseCoopers LLP are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

NeitherNone of the Bylaws, nor other governing documents or law requirerequires stockholder ratification of the selection of Ernst & YoungPricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm. However, the Audit Committee of the Board is submitting the selection of Ernst & YoungPricewaterhouseCoopers LLP to the stockholders for ratification as a matter of good corporate governance practice. If the stockholders fail to ratify the selection, the Audit Committee of the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee of the Board of Directors in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

The affirmative voteratification of the holdersselection of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2020 will be approved if a majority of the shares present in person or represented by proxy and entitled to votevotes cast at the Annual Meeting will be required to ratifyvote “FOR” the selection of Ernst & Young LLP.ratification. Abstentions will be counted toward the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Brokerbroker non-votes are counted towardstoward a quorum, but are not counted for any purpose in determining whether this matter has been approved.

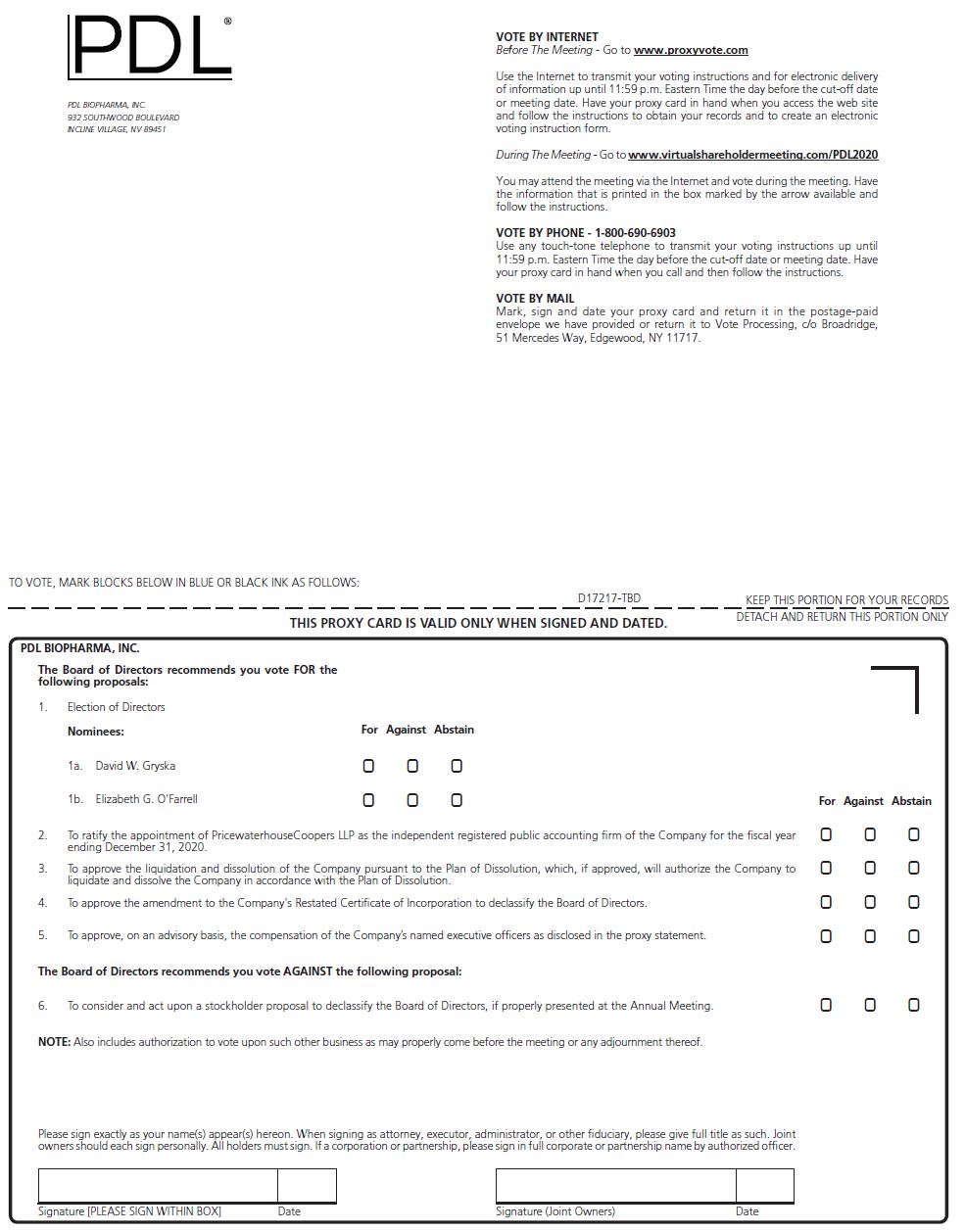

Principal Independent Registered Public Accounting Firm Fees and Services

The aggregate fees billed to the Company for the fiscal years ended December 31, 20122019 and 2011,2018, by Ernst & YoungPricewaterhouseCoopers LLP, the Company’s independent registered public accounting firm are set forth in the table below:

| ($ in thousands) | | 2012 | | | % of Total | | | 2011 | | | % of Total | |

| Fee Category | | | | | | | | | | | | |

Audit Fees(1) | | $ | 316 | | | | 85.9 | % | | $ | 339 | | | | 75.9 | % |

Audit-related Fees(2) | | | 50 | | | | 13.6 | % | | | 106 | | | | 23.7 | % |

Tax Fees(3) | | | — | | | | — | | | | — | | | | — | |

All Other Fees(4) | | | 2 | | | | 0.5 | % | | | 2 | | | | 0.4 | % |

Total Fees | | $ | 368 | | | | 100.0 | % | | $ | 447 | | | | 100.0 | % |

|

| | | | | | | | |

| ($ in thousands) | | 2019 | | 2018 |

| Fee Category | | | | |

Audit Fees(1) | | $ | 2,812 |

| | $ | 2,582 |

|

Audit-related Fees(2) | | — |

| | — |

|

Tax Fees(3) | | — |

| | — |

|

All Other Fees(4) | | 2 |

| | 4 |

|

| Total Fees | | $ | 2,814 |

| | $ | 2,586 |

|

|

| | | |

| (1) | | Audit fees consist of fees billed for professional services rendered for the audit of our consolidated financial statements, attestation services surrounding the effectiveness of our internal control environment and review of the interim condensed consolidated financial statements included in quarterly reports, the audit of our subsidiary, QHP Royalty Sub LLC, andreports. It also includes services that are normally would be provided by Ernst & Young LLP in connection with statutory and regulatory filings or engagements and services that generally only the principal auditor reasonably can provide to a client, such as comfort letters, attestation services except(except those not required by statute or regulation.regulation), procedures related to audit of income tax provisions and related reserves, consents and assistance with and review of documents filed with the SEC. |

| (2) | | Audit-related fees consist of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of our consolidated financial statements and are not reported under “Audit Fees.” In 2012 and 2011, these services included accounting consultations for income generating assets, debt modifications and cash flow hedge agreements. |

| (3) | | Tax fees consist of fees for tax compliance, tax advice and tax planning. No such services were incurred in 2012 or 2011. |

| (4) | | All other fees include any fees billed that are not audit, audit related or tax fees. In 20122019 and 2011,2018, these fees included a license to an accounting research database.database and an accounting disclosure checklist. |

OurThe Audit Committee pre-approves all audit services provided by the independent registered public accounting firm and permissible non-audit services in excess of a certain de minimis amount provided by the independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services. OurThe Audit Committee has a policy for the pre-approval of services provided by the independent registered public accounting firm. Under the policy, any pre-approval is detailed as to the particular service or category of services and includes an estimate of the related fees. OurThe Audit Committee may delegate pre-approval authority to one or more of its members. Such a member must report any decisions to ourthe Audit Committee at the next scheduled meeting. During fiscal years 20122019 and 2011, our2018, the Audit Committee approved all of the Audit Fees, Audit-Related Fees and All Other Fees.fees described above.

THE BOARD RECOMMENDS A VOTE “FOR” PROPOSAL NO. 2.

PROPOSAL NO. 3:

APPROVAL OF AMENDMENT TO THE RESTATED CERTIFICATE OF INCORPORATIONApproval of the dissolution pursuant to the plan of DISSOLUTION

General

Proposal No. 3 concerns the approval of the Dissolution Proposal. The Board has determined that the Dissolution is advisable and in the best interests of the Company and its stockholders, has approved the Dissolution and has adopted the Plan of Dissolution. A copy of the Plan of Dissolution is attached as Annex A to this proxy statement and incorporated herein by reference. As discussed below, the Board has determined to seek approval for the Dissolution in the event that a sale of the Company is not consummated or the Board determines that a sale of the Company will not maximize value to our stockholders. Certain material features of the Plan of Dissolution are summarized below. Stockholders are urged to carefully read the Plan of Dissolution in its entirety.

The Dissolution is subject to the condition that the holders of a majority of our outstanding shares of common stock authorize the Dissolution at the Annual Meeting. The Board recommends a vote “FOR” the approval of the Dissolution pursuant to the Plan of Dissolution.

In general terms, when we dissolve pursuant to the Dissolution, we will cease conducting our business, wind up our affairs, dispose of our non-cash assets, pay or otherwise provide for our obligations, and distribute our remaining assets, if any, during a post-dissolution period of at least three years, as required by the DGCL. The effective time of the Dissolution will be when the Certificate of Dissolution is filed with the office of the Secretary of State of the State of Delaware or such later date and time that is stated in the Certificate of Dissolution. With respect to the Dissolution, we will follow the dissolution and winding up procedures prescribed by the DGCL, as described in further detail under the heading “Delaware Law Applicable to Our Dissolution” beginning on page 35. If the stockholders approve the Dissolution Proposal, the Company currently plans to target the end of 2020 to file the Certificate of Dissolution with the Secretary of State of the State of Delaware, but recognizes this may be delayed given the uncertainties related to the COVID-19 pandemic. In addition, such filing may be delayed as determined by the Board in its sole discretion, as described in more detail below.

Following the filing of the Certificate of Dissolution, in accordance with the applicable provisions of the DGCL, the Board will proceed to wind up the Company’s affairs. Authorization of the Dissolution by the holders of a majority of the outstanding stock of the Company shall constitute the authorization of the sale, exchange or other disposition in liquidation of all of the remaining property and assets of the Company after the effective time of the Dissolution, whether the sale, exchange or other disposition occurs in one transaction or a series of transactions, and shall constitute ratification of any and all contracts for sale, exchange or other disposition that are conditioned on stockholder approval. The Company intends to rely on the “safe harbor” procedures under Sections 280 and 281(a) of the DGCL to, among other things, obtain an order from the Delaware Court of Chancery establishing the amount and form of security for contested known, contingent and potential future claims that are likely to arise or become known within five years filing of the Certificate of Dissolution (or such longer period of time as the Delaware Court of Chancery may determine not to exceed ten years) (the Court Order). We will pay or make reasonable provision for our uncontested known claims and expenses and establish reserves for other claims as required by the Court Order. The remaining assets or cash of the Company will be used to make liquidating distributions to stockholders.

If stockholders do not approve the Dissolution Proposal, we will continue our corporate existence and the Board will continue to explore alternatives for returning capital to stockholders in a manner intended to maximize value and in accordance with our monetization strategy.

Our liquidation, winding up and distribution procedures will be further guided by our Plan of Dissolution, as described in further detail under the heading “Description of our Plan of Dissolution” beginning on page 6. You should carefully consider the risk factors relating to our complete liquidation and dissolution and described under the heading “Risks Related to The Dissolution” beginning on page 11.

The description of the Dissolution contained in this introductory section is general in nature and is subject to various other factors and requirements, as described in greater detail below.

Background of the Proposed Dissolution and Plan of Dissolution

In September 2019, we engaged financial and legal advisors and initiated a review of our strategy. In December 2019, we disclosed that we planned to halt the execution of our growth strategy, cease making additional strategic transactions and investments and instead pursue a formal process to unlock the value of our portfolio by monetizing our assets and ultimately distributing net proceeds to stockholders.

Over the subsequent months, our board of directors and management analyzed, together with outside financial and legal advisors, how to best capture value pursuant to our monetization strategy and best return the significant intrinsic value of the high-quality assets in our portfolio to our stockholders. While, as noted herein, we have targeted the end of 2020 for the sale of our Material Assets (as defined below), we further recognize that, the duration and extent of the public health issues related to the COVID-19 pandemic make it possible, and perhaps probable, that the timing of the sale of all or substantially all of the Company’s assets, including the Material Assets, and therefore the timing of the Dissolution, may be delayed. As a result, we will continue to assess the market for our assets so as to balance the cost of continuing to incur general and administrative expenses against the state of the market for our assets so that we may determine the appropriate time to sell the Material Assets and other assets of the Company.

Pursuant to our monetization strategy, we are exploring a variety of potential transactions, including a sale of the whole company, divestiture of assets, spin-offs of operating entities, merger opportunities or a combination thereof. In addition, we have analyzed, and continue to analyze, the optimal mechanisms for returning value to stockholders in a tax-efficient manner, including via share repurchases, cash dividends and other distributions of assets. We have not set a definitive timeline and intend to pursue monetization in a disciplined and cost-effective manner seeking to maximize returns to stockholders. We also recognize, however, that accelerating the timeline, while continuing to seek to optimize asset value, could increase returns to stockholders due to reduced general and administrative expenses as well as potentially provide faster returns to stockholders.

Our focus throughout 2020 and continuing until Dissolution, if approved by our stockholders, will be the monetization and execution of potential transactions for the sale of the Company and/or the disposition of certain material assets, including, without limitation, the following assets: (1) our ownership interest in Noden Pharma DAC and Noden Pharma USA Inc. (collectively, Noden) and the branded prescription medicine products sold under the name Tekturna® and Tekturna HCT® in the United States, Rasilez® and Rasilez HCT® in the rest of the world, and an authorized generic form of Tekturna in the United States (collectively, the Noden Products); (2) our ownership interest in LENSAR, Inc. (LENSAR) and the LENSAR® Laser System; (3) our investment in shares of Evofem Biosciences, Inc. (Evofem); and (4) certain royalty rights and hybrid notes/royalty receivables (collectively, the Material Assets). In furtherance of these efforts and to assist us in our monetization strategy, at the end of 2019 we retained Bank of America Securities to advise us in a process for a sale of the Company. We have also retained SVB Leerink to advise us generally regarding the monetization strategy. In the event that we conclude that a whole company sale will not maximize value, and that a sale of the assets of the Company, separately or in combination, will provide more significant stockholder value, we have retained Torreya Partners to advise us in our monetization of our Noden asset and shares of Evofem, SVB Leerink to advise us in our monetization of LENSAR and the LENSAR® Laser System, and BofA Securities to advise us in a sale of our royalty assets. BofA Securities has also been retained to advise us on a sale of the whole company.

During the ongoing strategic process and in connection with the implementation and execution of our monetization strategy, the Board discussed from time-to-time its plan to liquidate and dissolve the Company following the consummation of the sale of all or substantially all of the Company’s assets, including the Material Assets. Upon the disposition of the Material Assets pursuant to our monetization strategy, rather than using the combination of the proceeds from our monetization strategy and sale of the Material Assets to continue operations of the Company, the Board has determined that the more advisable course of action would be to liquidate and dissolve so that we can have the opportunity to provide some distribution of assets to our stockholders, after we take care of various obligations and contingencies, as described elsewhere in this proxy statement.

On February 3, 2020, members of our Board were provided with a draft Plan of Complete Liquidation (the Plan of Liquidation) and a preliminary description of the Dissolution. The Plan of Liquidation provided to the Board outlined a plan to maximize value to stockholder by the end of 2020 through a complete liquidation of assets, including the engagement of various financial advisors to assist with the disposition of each of the Material Assets. At meetings of the Board held on February 6, 2020 and February 7, 2020, the Board reviewed the Plan of Liquidation, including a discussion of the Material Assets and expected value to stockholders by monetizing such assets by the end of 2020. After further discussion, the Board unanimously approved the Plan of Liquidation, including the asset monetization timeline and strategy.

On April 24, 2020, members of our Board were provided with a draft Plan of Dissolution, as well as a description of the Dissolution, to be considered in preparation for the Board meeting to be held on May 4, 2020. At the May 4, 2020 meeting, our Board further considered the Plan of Dissolution and the Dissolution. During this meeting, members of our Board had the opportunity to ask questions about the legal aspects of the Plan of Dissolution and the Dissolution, and the Board’s questions were answered by outside financial and legal advisors and our executive officers. Our Board determined that, following the disposition of the Material Assets, or at such earlier time as the Board determines in its sole discretion that such disposition of certain of the Material Assets or a sale of the Company is unlikely to maximize the value that can be returned to stockholders from our monetization strategy, the Company would, if approved by the stockholders, file a Certificate of Dissolution in Delaware and proceed to wind-down and dissolve the company in accordance with Delaware law.

After further discussion at the May 4, 2020 meeting, our Board unanimously determined that the Dissolution was advisable and in the best interests of us and our stockholders, adopted the Plan of Dissolution, authorized and approved the proposed Dissolution, recommended that our stockholders authorize and approve the proposed Dissolution in accordance with the Plan of Dissolution, and, subject to approval by our stockholders, generally authorized our officers to take all necessary actions to effect the Plan of Dissolution and our Dissolution in accordance with the Plan of Dissolution. The Plan of Dissolution approved by the Board is attached to this proxy statement as Annex A.

Reasons for the Dissolution

The decision of the Board to seek your approval for the Dissolution Proposal followed a lengthy process which the Board consulted with management and financial, accounting and legal advisors and carefully considered the risks, timing, viability and potential impact to our stockholders of the alternatives potentially available to us. Based on such consideration and analysis, the Board determined that the Dissolution pursuant to the Plan of Dissolution is advisable and in the best interests of us and our stockholders.

The Board considered the following factors, among others, in favor of the Dissolution pursuant to the Plan of Dissolution:

the determination by our Board, after conducting a review of our financial condition, evaluation of potential strategic alternatives, prospects for the sale of the Company as a whole or the sale of all or substantially all of the Company’s assets, including the Material Assets, in individual sales, the results of operations and our future business prospects, that continuing to operate as a going concern is not reasonably likely to create greater value for the stockholders than the value that may be obtained for the stockholders pursuant to the sale of all or substantially all of the Company’s assets, including the Material Assets, and the Dissolution;

the sale of all or substantially all of the Company’s assets, including the Material Assets, and the Dissolution provide our stockholders with an opportunity to potentially monetize their investment in the Company and allows us to distribute the maximum amount of cash to the Company’s stockholders from the sale of all or substantially all of the Company’s assets, including the Material Assets;

commencing the dissolution process under the DGCL, including the mailing of notices to claimants and the requirement that claimants respond by a specified date or their claims will be barred, may facilitate an earlier resolution of certain claims against the Company;

the material costs associated with our business operations, including accounting, legal and other expenses in connection with required filings with the SEC and required to support the day-to-day operations of our various operating segments and our prior growth strategy;

the range of aggregate net proceeds which may be realizable by us from the sale of all or substantially all of the Company’s assets, including the Material Assets;

under Sections 281(c) and 282 of the DGCL, by following the “safe harbor” procedures under Sections 280 and 281(a) of the DGCL, directors of a dissolved corporation would be protected from personal liability to claimants of the dissolved corporation for failing to make adequate provision for such corporation’s actual and potential liabilities, and each stockholder’s potential liability would be limited in the aggregate to the amount distributed to such stockholder in the dissolution and further limited to claims filed before the expiration of the winding-up period;

the Dissolution Proposal is subject to approval by our stockholders and allows stockholders to have a direct vote on whether they concur with such proposal as a favorable outcome for the Company and its stockholders;

the terms and conditions of the Plan of Dissolution permit the Board to abandon or delay implementation of the dissolution prior to the filing of the Certificates of Dissolution if it determines that, in light of new proposals presented or changes in circumstances, a dissolution is no longer advisable and in the best interests of the Company and its stockholders;

that under the DGCL, if the circumstances justifying the Dissolution change, the Certificate of Dissolution may be revoked after the effective time of the Dissolution if the Board adopts a resolution recommending revocation and if the stockholders originally entitled to vote on the Dissolution approve such revocation at a meeting of stockholders; and

there are potential U.S. federal income tax benefits of the Plan of Dissolution to our stockholders, including that distributions received by a U.S. Holder (as defined in “Material U.S. Federal Income Tax Consequences of the Proposed Dissolution” beginning on page 46 of this proxy statement) pursuant to the Plan of Dissolution are intended to be treated as a reduction in the U.S. Holder’s tax basis in such holder’s shares of our common stock, but not below zero, with any excess taxable as capital gain; for a more detailed discussion, see “Material U.S. Federal Income Tax Consequences of the Proposed Dissolution” beginning on page 45 of this proxy statement.

The Board also considered certain material risks or potentially unfavorable factors in arriving at its conclusion that the Dissolution is advisable and in the best interests of us and our stockholders, including, among others:

there are uncertainties as to the timing, nature and amount of any liquidating distributions to stockholders, including the risk that there could be unanticipated delays in selling all or substantially all of the Company’s assets, including the Material Assets, and the amounts we would ultimately distribute to our stockholders pursuant to the Plan of Dissolution may be substantially less than the amounts we currently estimate if the amounts of our liabilities, other obligations and expenses and claims against us are higher than we currently anticipate;

it is possible that the timing of the sale of all or substantially all of the Company’s assets, including the Material Assets, and therefore the timing of the Dissolution, may be delayed and significantly impacted by public health issues related to the COVID-19 pandemic;

it is possible that the aggregate liquidating distributions that would be paid to a stockholder under the Plan of Dissolution would not exceed the amount that the stockholder could have received upon sales of its shares of the Company in the open market;

the uncertainty of value, if any, of the Material Assets;

the disposition of our remaining assets will be subject to corporate-level U.S. federal, state and local tax;

the announcement of the Dissolution Proposal may cause significant turnover in our stockholder base, which may cause us to undergo an “ownership change” (generally defined as a greater than 50 percentage point change (by value) in our equity ownership over a three-year period) and limit our ability to use our pre-change net operating loss carryforwards and other pre-change tax attributes;

the Board and our executive officers may have interests in the Plan of Dissolution that are different from, or in addition to, the interests of stockholders generally;

in the event we fail to create adequate reserves for payment of the amounts ultimately payable in respect of expenses and liabilities, creditors may seek recovery from our stockholders and our stockholders may be required to return to certain creditors some or all of the liquidating distributions;

the fact that, under the DGCL, our stockholders are not entitled to appraisal rights for their shares of common stock in connection with the Dissolution;

potential changes in applicable laws (including tax laws) and regulations;

risk of diverting management focus and resources from other strategic options and from operational matters while working to implement the Dissolution; and

if the Dissolution pursuant to the Plan of Dissolution is approved by our stockholders, holders of shares of our common stock would generally not be permitted to transfer the shares of common stock after the effective time of the Dissolution, and such lack of liquidity and the delisting of our common stock from the Nasdaq Stock Market may adversely affect the trading prices of our common stock prior to the effective time of the Dissolution.

Our Board also considered the other factors described in the section entitled “Risks Related to the Dissolution” of this Proxy Statement and under the caption “Risk Factors” in our Form 10-K for the fiscal year ended December 31, 2019 filed with the SEC and other documents we file with or furnish to the SEC, in deciding to approve, and recommend that our stockholders approve, the Plan of Dissolution.

The preceding discussion is not intended to be an exhaustive description of the information and factors considered by our Board, but addresses the material information and factors considered. In view of the variety of factors considered in connection with its evaluation of the Plan of Dissolution, our Board did not find it practical and did not quantify or otherwise attempt to assign relative weight to the specific factors considered in reaching its conclusions. In addition, our Board did not undertake to make any specific determination as to whether any particular factor, or any aspect of any particular factor, was favorable or unfavorable to its ultimate determination, but rather conducted an overall analysis of the factors described above. In considering the factors described above, individual members of our Board may have given different weight to different factors.

At this time, our Board has considered all of the strategic alternatives the Board has to date considered feasible and has determined that the Dissolution is advisable and in the best interests of us and our stockholders, and to return to our stockholders the company’s remaining assets and/or cash that are not necessary to provide for the Company’s liabilities. The Board, however, retains the right to consider additional alternatives that may develop and abandon or delay implementation of the Plan of Dissolution should a superior alternative arise before the filing of the Certificate of Dissolution with the Delaware Secretary of State.

Estimated Distribution to Stockholders

We estimate that we will have between approximately $350 million to $700 million of cash and other non-cash assets that we will be able to distribute to our stockholders in connection with the Dissolution, which implies a per share distribution with an aggregate value of between approximately $2.98 and $5.97 based on 117,285,043 shares outstanding as of April 24, 2020. We cannot predict with certainty the amount of cash available to distribute to our stockholders in connection with the Dissolution, nor can we predict with certainty the value of other non-cash assets, if any, that may be distributed to our stockholders in connection with the dissolution, until such time as we are able to dispose of all or substantially all of the Company’s assets, including the Material Assets, if any. Calculating such an estimate is inherently uncertain and requires that we make a number of assumptions regarding future events, many of which are unlikely to ultimately be true and are not known at this time. We used the following assumptions when calculating the range of estimated distributable value of cash and other non-cash assets: (i) the purchase price of all or substantially all of our assets, including the Material Assets, will not be adjusted for any tax contingencies, (ii) we file the Certificate of Dissolution and implement the Plan of Dissolution shortly after closing of the sale of our Material Assets, (iii) there are no currently unknown or unanticipated material liabilities, and no such liabilities arise or are identified after the filing of the Certificate of Dissolution, (iv) the estimate of the Company’s known, contingent or future liabilities, including related to the FTB audit and the IRS audit (each as defined below) is reasonable and materially accurate, (v) the accounting for our liabilities (including those that are presently unknown), which involves estimates and complex valuations, (vi) certain tax provisions of the recently enacted Coronavirus Aid, Relief, and Economic Security Act, which allow net operating losses generated in tax years beginning after December 31, 2017 and before January 1, 2021, to be carried back to each of the five preceding tax years for federal income tax purposes, and (vii) the number of our employees will be reduced substantially following the effective time of the Dissolution and as our various assets are disposed of in accordance with our monetization strategy.

Further, we made a number of assumptions regarding the future value of the sale of the Material Assets prior to Dissolution, including: (i) the sales of the Material Assets may be made in one or more installments, (ii) the Board’s estimate of the transaction-related costs in connection with the sale of all or substantially all of the Company’ assets, including the Material Assets, is reasonable and materially accurate, (iii) each of the Material Assets shall be disposed of in connection with a sale, (iv) the timing and value realized upon sale of any of the Company’s assets would not be subject to material delay or other limitations as a result of public health issues related to the COVID-19 pandemic, (v) the Board’s estimate as to the impact on the valuation of the Material Assets as a result of COVID-19, including any potential discount applied to the Board’s estimate of realizable proceeds or value that may be obtained upon disposition as a result thereof, is reasonable and materially accurate, (vi) the Board’s estimate of the net proceeds to be received by the Company from each of the sales of the Material Assets is reasonable and materially accurate, (vii) there are no asset-specific interdependencies, and (viii) assumptions specific to timing and value to be received upon the sale of each individual Material Asset, including, without limitation, (A) our ownership interest in Noden and the Noden Products would be acquired by either a strategic buyer with substantial revenue, cost and financial synergies, or a financial buyer with limited revenue, cost and financial synergies, (B) our ownership interest in LENSAR and the LENSAR® Laser System would be acquired by a buyer at a value that reflects the future cash flows that the buyer could realize by commercializing LENSAR’s proprietary and differentiated technologies, the amount of which we considered based on recently conducted market research and discussions with a financial advisor, or LENSAR will be spun-out as a public company and the shares distributed to our shareholders, the value of which we considered based on public company forward revenue multiples and discussions with a financial advisor, (C) our shares of Evofem will be either distributed to our stockholders or sold in a private transaction, a marketed secondary public offering at the then-current market price or on the open market at then-current market price, which we have assumed for purposes of this Proxy Statement to be a recent volume weighted average price prior to the filing of this Proxy Statement, and is subject to change based on prevailing market conditions and other factors, and (D) the sale of royalty rights and hybrid notes/royalty receivables will be subject to a competitive bidding process with robust demand among potential acquirors.

The Board also considered and relied upon, without independent verification, information provided by its financial advisors engaged to assist with the disposition of each of the Material Assets.

As discussed above, our estimate of the amounts we may distribute to our stockholders in connection with the Dissolution includes the potential distribution of certain non-cash assets. Although we currently anticipate that we will sell each of the Material Assets prior to the Dissolution, our Board is evaluating alternative transactions with respect to certain assets, including a potential taxable spin-off of LENSAR and the LENSAR® Laser System. In accordance with the Plan of Liquidation, the Company is concurrently evaluating a spin-off transaction which, if consummated, would result in our stockholders receiving equity securities in LENSAR. The value of any equity securities received if a spin-off transaction is consummated is included in our estimate of the total amounts distributable to stockholders referenced above. The spin-off transaction can be carried out independently of the divestitures of the other assets of the Company. While our preference is to distribute cash to our shareholders from a sale of LENSAR, if a sale alternative is not available at this time, possibly due to the COVID-19 pandemic or other uncertainties, or if the Board, with the advice of its financial advisors, believes that the value in a spin-off could generate greater value to its shareholders than a sale transaction, then it will undertake (or pursue) a spin-off.

In addition to the sale or disposition of the Material Assets as discussed above, we similarly anticipate selling or disposing of, or receiving proceeds from, each of our remaining assets. Such assets include:

the resulting outcome of continued litigation of claims filed by the Company against the guarantors of obligations owed to the Company by Wellstat Diagnostics, LLC (the Wellstat Diagnostics Guarantors) under a credit agreement that we entered into, as a lender, with Wellstat Diagnostics, LLC;

principal and interest payments due under a credit agreement entered into by the Company, as a lender, with CareView Communications, Inc., the recoverable amount of which is expected to be substantially less than the principal and interest payable;

amounts received in connection with our agreement with a counterparty pursuant to which we sold the remaining assets of DFM, LLC, to which we are entitled to a single-digit percentage of any net final award in connection with its monetization process using certain intangible assets included in the sale;

amounts received from a royalty based on a “know-how” license for technology provided in the design of solanezumab, an Eli Lilly-licensed humanized monoclonal antibody being tested in a study of older individuals who may be at risk of memory loss and cognitive decline due to Alzheimer’s disease. The 2% royalty on net sales is payable for 12.5 years after the product’s first commercial sale, and is currently in ongoing clinical studies with Phase 3 testing results expected in July of 2022; and

proceeds from our investment in shares of Alphaeon Corporation.

We are considering the monetization of the foregoing assets prior to the filing of the Certificate of Dissolution, but such assets may mature into more significant value for our stockholders following the Dissolution.

Our estimate of the anticipated distribution amounts are preliminary and subject to change and many of the factors that are necessary to determine how much, if any, we will be able to distribute to our stockholders in liquidation are subject to change and outside of our control. The foregoing estimates are qualified by the assumptions set forth above, are subject to numerous uncertainties, and may not reflect the total range of possible outcomes, and actual amounts may differ materially from such estimates. We have attempted to make reasonable estimates and assumptions, but if any of such estimates or assumptions are inaccurate, the actual amount we distribute to our stockholders may be lower or higher than the estimated range. It is possible that the aggregate liquidating distributions that would be paid to a stockholder under the Plan of Dissolution would not exceed the amount that the stockholder could have received upon sales of its shares of common stock in the open market. It is not possible to predict with certainty what the amount of aggregate liquidating distributions ultimately will be. While we intend to pursue matters related to our liquidation and winding up as quickly as possible after completion of the sale of our Material Assets, the timing thereof is also subject to numerous risks and uncertainties. For a discussion of risks related to the Dissolution and the estimates, assumptions and uncertainties related thereto, stockholders are urged to review the risk factors set forth in the section entitled “Risks Related to the Dissolution” of this Proxy Statement and under the caption under the caption “Risk Factors” in our Form 10-K for the fiscal year ended December 31, 2019 filed with the SEC and the other documents we file with or furnish to the SEC. Further, the timing of many elements of this process after our Dissolution will not be entirely within our control and, therefore, we are unable to estimate when we would be able to begin making any post-Dissolution liquidating distributions to our stockholders. See “Risks Related to The Dissolution” beginning on page 11. The timing of any distributions to our stockholders after the filing of the Certificate of Dissolution will in large part depend on our ability to pay or make adequate provision for payment of all of our liabilities and obligations in the manner provided under the DGCL following the filing of the Certificate of Dissolution, the timing of the sale of our assets and our ability to provide for the payment of liabilities and obligations that are not identified or not fixed at the time of the filing of the Certificate of Dissolution. Under the DGCL, before a dissolved corporation may make any distributions to its stockholders, it must pay or make reasonable provision to pay all of its liabilities and obligations, including all contingent, conditional or unmatured claims known to the corporation, and claims which, based on facts known to the corporation, are likely to arise or become known to the corporation within five years (or such longer period of time as the Delaware Court of Chancery may determine, not to exceed ten years). We are unable to currently determine the amount of all liabilities and obligations that we will owe, or the amount of a contingency reserve we will be required to establish, upon the filing of the Certificate of Dissolution. As a result, we anticipate a substantial period of time may transpire between the filing of the Certificate of Dissolution and any liquidating distributions to our stockholders.

The Plan of Dissolution gives the Board of Directors, to the fullest extent permitted by law, the authority to liquidate all of our assets in the manner that is in the best interest of the Company’s stockholders after the filing of the Certificate of Dissolution. In accordance with Section 271 of the DGCL, the sale of all or substantially all of our assets will require additional approval of our stockholders. We are unable to determine at this time whether any such stockholder approval will be required in connection with the disposition of our assets prior to Dissolution.

Delaware Law Applicable to our Dissolution

We are a corporation organized under the laws of the State of Delaware and the Dissolution will be governed by the DGCL. The following is a brief summary of some of the DGCL provisions applicable to the Dissolution. The following summary is qualified in its entirely by Sections 275 through 283 of the DGCL, which are attached to this proxy statement as Annex B.

Delaware Law Generally

Authorization of Board and Stockholders. If a corporation’s board of directors deems it advisable that the corporation should dissolve, it may adopt a resolution to that effect by a majority vote of the whole board and notify the corporation’s stockholders entitled to vote on the dissolution of the adoption of the resolution and the calling of a meeting of stockholders to act on the resolution. Our Board has unanimously adopted a resolution deeming the Dissolution advisable and in the best interests of us and our stockholders. This proxy statement and its accompanying materials constitute a notice to this effect to our stockholders and a notice of the Annual Meeting at which our stockholders of record on the Record Date may vote to approve the Dissolution, among other matters. The Dissolution must be authorized and approved by the holders of a majority of our outstanding common stock on the Record Date entitled to vote on the Dissolution Proposal.

Certificate of Dissolution. If a corporation’s stockholders authorize its dissolution, to consummate the dissolution the corporation must file a certificate of dissolution with the Secretary of State of the State of Delaware. The certificate of dissolution must include the corporation’s name, the date the dissolution was authorized, a statement that the dissolution has been authorized by the corporation’s board of directors and stockholders, the names and addresses of the directors and officers of the corporation and the date that the corporation’s original certificate of incorporation was filed with the Secretary of State of the State of Delaware. If our stockholders authorize the Dissolution at the Annual Meeting, we plan to target the end of 2020 to file the Certificate of Dissolution with the Secretary of State of the State of Delaware, but recognize this may be delayed given the uncertainties related to the COVID-19 pandemic. Ultimately, the timing of such filing is subject to the discretion of the Board, and may depend on our ability to successfully execute our monetization strategy. Prior to filing the Certificate of Dissolution, we intend to continue to explore alternatives for returning capital to stockholders in a manner intended to maximize value and in accordance with our monetization strategy. Following the completion of the sale of all or substantially all of the Company’s assets, including the Material Assets, or such earlier time as the Board determines in its sole discretion that disposition of certain of the Material Assets or a sale of the Company is unlikely to maximize the value that can be returned to stockholders from our monetization strategy, we will file the Certificate of Dissolution as soon as practicable and in accordance with Delaware law. The timing and success of our monetization strategy, and therefore the targeted filing date of the Certificate of Dissolution, are subject to numerous risks and uncertainties, including, without limitation, the risk factors set forth in the section entitled “Risks Related to the Dissolution” of this Proxy Statement and under the caption “Risk Factors” in our Form 10-K for the fiscal year ended December 31, 2019 filed with the SEC and other documents we file with or furnish to the SEC.

Possible Permitted Abandonment of Dissolution. The resolution authorizing a dissolution adopted by a corporation’s board of directors may provide that, notwithstanding authorization of the dissolution by the corporation’s stockholders, the board of directors may abandon the dissolution without further action by the stockholders. While we do not currently foresee any reason that our Board would abandon our proposed Dissolution once it is authorized by our stockholders, to provide our Board with the maximum flexibility to act in the best interests of our stockholders, the resolutions adopted by our Board included this kind of provision.

Time of Dissolution. When a corporation’s certificate of dissolution is filed with the Secretary of State of the State of Delaware and has become effective, along with the corporation’s tender of all taxes (including Delaware franchise taxes) and fees authorized to be collected by the Secretary of State of the State of Delaware, the corporation will be dissolved.

Continuation of the Corporation After Dissolution

A dissolved corporation continues its existence for three years after dissolution, or such longer period as the Delaware Court of Chancery may direct, for the purpose of prosecuting and defending suits and enabling the corporation to settle and close its business, to dispose of and convey its property, to discharge its liabilities and to distribute to its stockholders any remaining assets. A dissolved corporation may not, however, continue the business for which it was organized. Any action, suit or proceeding begun by or against the corporation before or during this survival period does not abate by reason of the dissolution, and for the purpose of any such action, suit or proceeding, the corporation will continue beyond the three-year period until any related judgments, orders or decrees are fully executed, without the necessity for any special direction by the Delaware Court of Chancery. The Plan of Dissolution

will govern our winding up process after dissolution, and is described in further detail under the heading “Description of our Plan of Dissolution” beginning on page 6.

Payment and Distribution to Claimants and Stockholders

A dissolved corporation must make provision for the payment (or reservation of funds as security for payment) of claims against the corporation in accordance with the applicable provisions of the DGCL and the distribution of remaining assets to the corporation’s stockholders. The dissolved corporation may do this by following one of two procedures, as described below.

Safe Harbor Procedures under DGCL Sections 280 and 281(a) (the Safe Harbor Procedures)

A dissolved corporation may elect to give notice of its dissolution to persons having a claim against the corporation (other than claims against the corporation in any pending actions, suits or proceedings to which the corporation is a party) (the Current Claimants) and to persons with contractual claims contingent on the occurrence or nonoccurrence of future events or otherwise conditional or unmatured (the Contingent Contractual Claimants), and after giving these notices, following the procedures set forth in the DGCL, as described below.

Current Claimants

Notices and Publication. The notice to Current Claimants must state (1) that all such claims must be presented to the corporation in writing and must contain sufficient information reasonably to inform the corporation of the identity of the claimant and the substance of the claim; (2) the mailing address to which the claim must be sent; (3) the date (the Claim Date) by which the claim must be received by the corporation, which must be no earlier than 60 days from the date of the corporation’s notice; (4) that the claim will be barred if not received by the Claim Date; (5) that the corporation may make distributions to other claimants and the corporation’s stockholders without further notice to the Current Claimant; and (6) the aggregate annual amount of all distributions made by the corporation to its stockholders for each of the three years before the date of dissolution. The notice must be published at least once a week for two consecutive weeks in a newspaper of general circulation in the county in which the corporation’s registered agent in Delaware is located and in the corporation’s principal place of business and, in the case of a corporation having $10,000,000 or more in total assets at the time of dissolution, at least once in all editions of a daily newspaper with a national circulation. On or before the date of the first publication of the notice, the corporation must also mail a copy of the notice by certified or registered mail, return receipt requested, to each known claimant of the corporation, including persons with claims asserted against the corporation in a pending action, suit or proceeding to which the corporation is a party.

Effect of Non-Responses to Notices. If the dissolved corporation does not receive a response to the corporation’s notice by the Claim Date from a Current Claimant who was given actual notice according to the foregoing paragraph, then the claimant’s claim will be barred.

Treatment of Responses to Notices. If the dissolved corporation receives a response to the corporation’s notice by the Claim Date, the dissolved corporation may accept or reject, in whole or in part, the claim. If the dissolved corporation rejects a claim, it must mail a notice of the rejection to the Current Claimant by certified or registered mail, return receipt requested, within 90 days after receipt of the claim (or, if earlier, at least 150 days before the expiration of the post-dissolution survival period). The notice must state that any claim so rejected will be barred if the Current Claimant does not commence an action, suit or proceeding with respect to the claim within 120 days of the date of the rejection.

Effect of Non-Responses to Rejections of Claims. If the dissolved corporation rejects a claim and the Current Claimant does not commence an action suit or proceeding with respect to the claim within the 120-day post-rejection period, then the Current Claimant’s claim will be barred.

Contingent Contractual Claimants

Notices. The notice to Contingent Contractual Claimants (persons with contractual claims contingent on the occurrence or nonoccurrence of future events or otherwise conditional or unmatured) must be in substantially the same form and sent and published in the same manner, as notices to Current Claimants and shall request that Contingent Contractual Claimants present their claims in accordance with the terms of such notice.

Responses to Contractual Claimants. If the dissolved corporation receives a response by the date specified in the notice by which the claims from Contingent Contractual Claimants must be received by the corporation, which must be no earlier than 60 days from the date of the corporation’s notice to Contingent Contractual Claimants, the dissolved corporation must offer to the Contingent Contractual Claimant such security as the dissolved corporation determines is sufficient to provide compensation to the claimant

if the claim matures. This offer must be mailed to the Contingent Contractual Claimant by certified or registered mail, return receipt requested, within 90 days of the dissolved corporation’s receipt of the claim (or, if earlier, at least 150 days before the expiration of the post-dissolution survival period). If the Contingent Contractual Claimant does not deliver to the dissolved corporation a written notice rejecting the offer within 120 days after receipt of the offer for security, the claimant is deemed to have accepted the security as the sole source from which to satisfy the claim against the dissolved corporation.

Determination by Delaware Court of Chancery

A dissolved corporation that has complied with the Safe Harbor Procedures must petition the Delaware Court of Chancery to determine the amount and form of security that will be (1) reasonably likely to be sufficient to provide compensation for any claim against the dissolved corporation that is the subject of a pending action, suit or proceeding to which the dissolved corporation is a party, other than a claim barred pursuant to the Safe Harbor Procedures, (2) sufficient to provide compensation to any Contingent Contractual Claimant who has rejected the dissolved corporation’s offer for security for such person’s claims made pursuant to the Safe Harbor Procedures, and (3) reasonably likely to be sufficient to provide compensation for claims that have not been made known to the dissolved corporation or that have not arisen but that, based on facts known to the dissolved corporation, are likely to arise or to become known to the dissolved corporation within five years after the date of dissolution or such longer period of time as the Delaware Court of Chancery may determine, not to exceed ten years after the date of dissolution.

Payments and Distribution

If a dissolved corporation has followed the Safe Harbor Procedures, then it will (1) pay the current claims made but not rejected, (2) post the security offered and not rejected for contractual claims that are contingent, conditional or unmatured, (3) post any security ordered by the Delaware Court of Chancery in response to the dissolved corporation’s petition to the court described above, and (4) pay or make provision for all other claims that are mature, known and uncontested or that have been finally determined to be owing by the dissolved corporation. If there are insufficient assets to make these payments and provisions, then they will be satisfied ratably in accordance with legal priorities, to the extent that assets are available.

All remaining assets will be distributed to the dissolved corporation’s stockholders, but not earlier than 150 days after the date of the last notice of rejection given by the dissolved corporation to a Current Claimant pursuant to the Safe Harbor Procedures.

Alternative Procedures under DGCL Section 281(b) (the Alternative Procedures)

If a dissolved corporation does not elect to follow the Safe Harbor Procedures, it must adopt a plan of distribution pursuant to which it will (1) pay or make reasonable provision to pay all claims and obligations, including all contingent, conditional or unmatured contractual claims known to the corporation, (2) make such provision as will be reasonably likely to be sufficient to provide compensation for any claim against the dissolved corporation that is the subject of a pending action, suit or proceeding to which the dissolved corporation is a party and (3) make such provision as will be reasonably likely to be sufficient to provide compensation for claims that have not been made known to the dissolved corporation or that have not arisen but that, based on facts known to the dissolved corporation, are likely to arise or to become known to the dissolved corporation within ten years after the date of dissolution. If there are insufficient assets to make these payments and provisions, then they will be satisfied ratably in accordance with legal priorities, to the extent assets are available. All remaining assets will be distributed to the dissolved corporation’s stockholders.

Liabilities of Stockholders and Directors